Embarking on a journey beyond the borders of Canada is an exciting and enriching experience. Whether you’re planning a tropical escape, a European adventure, or an exploration of distant cultures, thorough preparation is essential for a smooth and worry-free trip. One crucial aspect that often goes overlooked is travel insurance. While the allure of foreign lands may captivate your imagination, the unforeseen challenges that can arise during your travels underscore the importance of securing comprehensive travel insurance.

Why Travel Insurance Matters

Medical Emergencies

One of the primary reasons to invest in travel insurance is to safeguard against unexpected medical emergencies. While Canada has an excellent healthcare system, accessing medical care abroad can be costly. Travel insurance provides coverage for medical expenses, ensuring you receive the necessary care without draining your savings.

Trip Cancellations and Interruptions

Life is unpredictable, and plans can change unexpectedly. Travel insurance protects your investment by covering trip cancellations or interruptions due to unforeseen events such as illness, family emergencies, or job-related issues. This means you won’t lose out on prepaid expenses like flights and accommodations.

Lost or Stolen Belongings

Travel insurance can be a financial safety net in the unfortunate event of lost or stolen belongings. Whether it’s your luggage, passport, or valuable items, insurance helps cover the cost of replacing these items, allowing you to focus on enjoying your trip rather than dealing with unexpected losses.

Travel Delays and Missed Connections

Flights can be delayed or connections missed, causing disruptions to your travel itinerary. Travel insurance often provides coverage for additional expenses incurred due to these delays, such as accommodation, meals, and alternative transportation arrangements.

Emergency Evacuation

In the event of a natural disaster or political unrest, emergency evacuation coverage becomes crucial. Travel insurance can facilitate the safe evacuation of travelers to their home country or a nearby safe location, ensuring their well-being in times of crisis.

Understand Your Needs

Consider the nature of your trip, your health conditions, and the activities you plan to engage in. Different travel insurance plans cater to varying needs, so choose one that aligns with your specific requirements.

Read the Fine Print

Thoroughly review the terms and conditions of your chosen travel insurance policy. Pay attention to coverage limits, exclusions, and any pre-existing conditions that may affect your eligibility for certain benefits.

Compare Plans

Take the time to compare different travel insurance plans. Look for reputable insurance providers, read customer reviews, and assess the overall value each plan offers in terms of coverage and cost. To ensure you have the best coverage that meets your specific needs, it’s essential to compare policies and take note of any differences. Some policies may offer additional benefits like emergency evacuation coverage, while others may have specific limitations or restrictions. Taking the time to research and compare policies can help you make an informed decision and give you peace of mind while enjoying your time away as a snowbird.

As you prepare to set foot on foreign soil, don’t let the excitement of your upcoming adventure overshadow the importance of travel insurance. Investing in comprehensive coverage not only provides financial security but also offers peace of mind, allowing you to fully immerse yourself in the wonders of your destination. Prioritize your well-being and protect your travel investment by making travel insurance an integral part of your journey beyond Canada’s borders. Safe travels!

I am always happy to provide free, no-obligation insurance quotes, consultation, or second opinion. Please feel free to reach out!

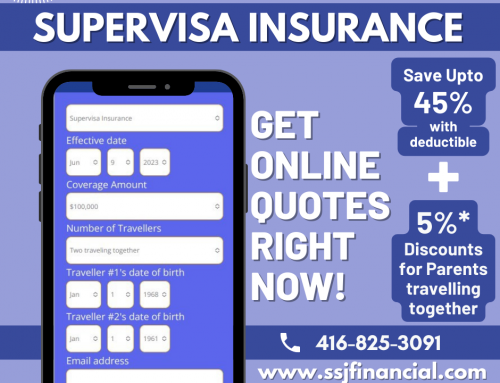

I specialize in emergency medical travel insurance for Visitors to Canada & Supervisa!

Visit my website to learn more & get instant quotes on Super Visa, Travel Insurance & Visitor insurance.