Planning a trip can be an exciting experience. To help you get started on planning a trip out of Canada, here are some general misconceptions about travel insurance.

Misconception 1 – Travel Insurance is Solely for Extreme Situations Unlikely to Happen to Me

We understand your perspective – feeling young and indestructible is common. When arranging travel, thoughts about potential mishaps or personal challenges might not cross your mind, especially when you’re in good health and full of energy.

Nonetheless, travel insurance encompasses more than just medical emergencies, and individuals of all age groups should contemplate obtaining coverage.

Travel Insurance is designed to help travelers brace for unforeseen costs associated with eligible emergency expenses during their journeys, should such situations arise. However, it can also provide assistance in covering unanticipated expenses arising from trip cancellations, luggage delays, and other unexpected events.

Another significant subject is coverage for pre-existing medical conditions. While having a pre-existing medical condition might not automatically disqualify you from getting insurance, your condition generally must be deemed “stable” for a specified period before your effective coverage date.

Misconception 2 – My Credit Card Insurance Automatically Provides Coverage

Vacations are meant for unwinding, but various unforeseen events, from flight delays to lost baggage, can turn your trip into an ordeal, burdening you with unnecessary stress.

Depending on the specifics of your credit card, you might qualify for various types of coverage, ranging from trip cancellations to lost baggage or car rental mishaps. Certain situations, like travel-related medical emergencies, could also be covered by your credit card insurance.

Nonetheless, not all credit cards extend travel insurance, and it’s prudent to examine the insurance provisions linked to your credit card before assuming you’re covered.

Misconception 3 – Provincial Health Insurance Suffices for Coverage

Even when traveling within Canada, your provincial health insurance – such as Ontario Health Insurance Plan (OHIP) or Medical Services Plan (MSP) – may not fully cover all types of medical expenses when you’re outside your province of residence.

For instance, if you venture beyond Ontario with OHIP coverage, the cost of ambulance services might not be included.

It’s crucial to familiarize yourself with your insurance coverage before embarking on your journey, potentially sparing yourself the headache in the event of an unforeseen circumstance.

Misconception 4 – Filing a Claim is Too Complex and Not Worth the Effort

As the adage goes, “Just because something is challenging doesn’t mean it’s not worthwhile.” The same applies to submitting an insurance claim – would you truly prefer to shoulder your medical expenses merely due to the need to provide evidence supporting your claim?

Most Insurance providers streamline the claims process through its Online Claim Portal, making it straightforward to submit documentation like medical bills or personal payments.

Should you require guidance, Insurance companies offers a support line to assist you through the claim filing procedure.

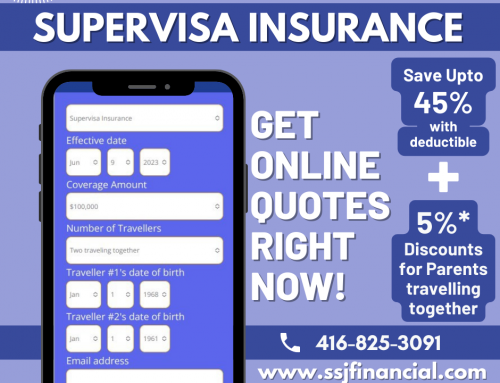

Amidst the plethora of travel insurance myths, our aim is to shield you from falling victim to misconceptions. To get a more comprehensive understanding of the of travel insurance or to get a quote, Call 416-825-3091 or visit ssjfinancial.com.

Remember that the specific steps may vary depending on your destination and the type of trip you’re planning. It’s also essential to stay updated on any travel advisories or COVID-19-related restrictions that may apply to your trip, as these can change rapidly. Safe travels!

I specialize in emergency medical travel insurance for Visitors to Canada & Supervisa! Visit my website to learn more & get instant quotes on Super Visa & Visitor insurance. I am always happy to provide free, no-obligation insurance quotes, consultation, or second opinion. Please feel free to reach out!

For any question regarding insurance, investment, for a no-obligation insurance quote, consultation & second opinion. Please feel free to reach out!

Swinder Jodhka

416-825-3091

Broker, SSJ Financial Services